0 Comments

1 category

Port of destination detention time

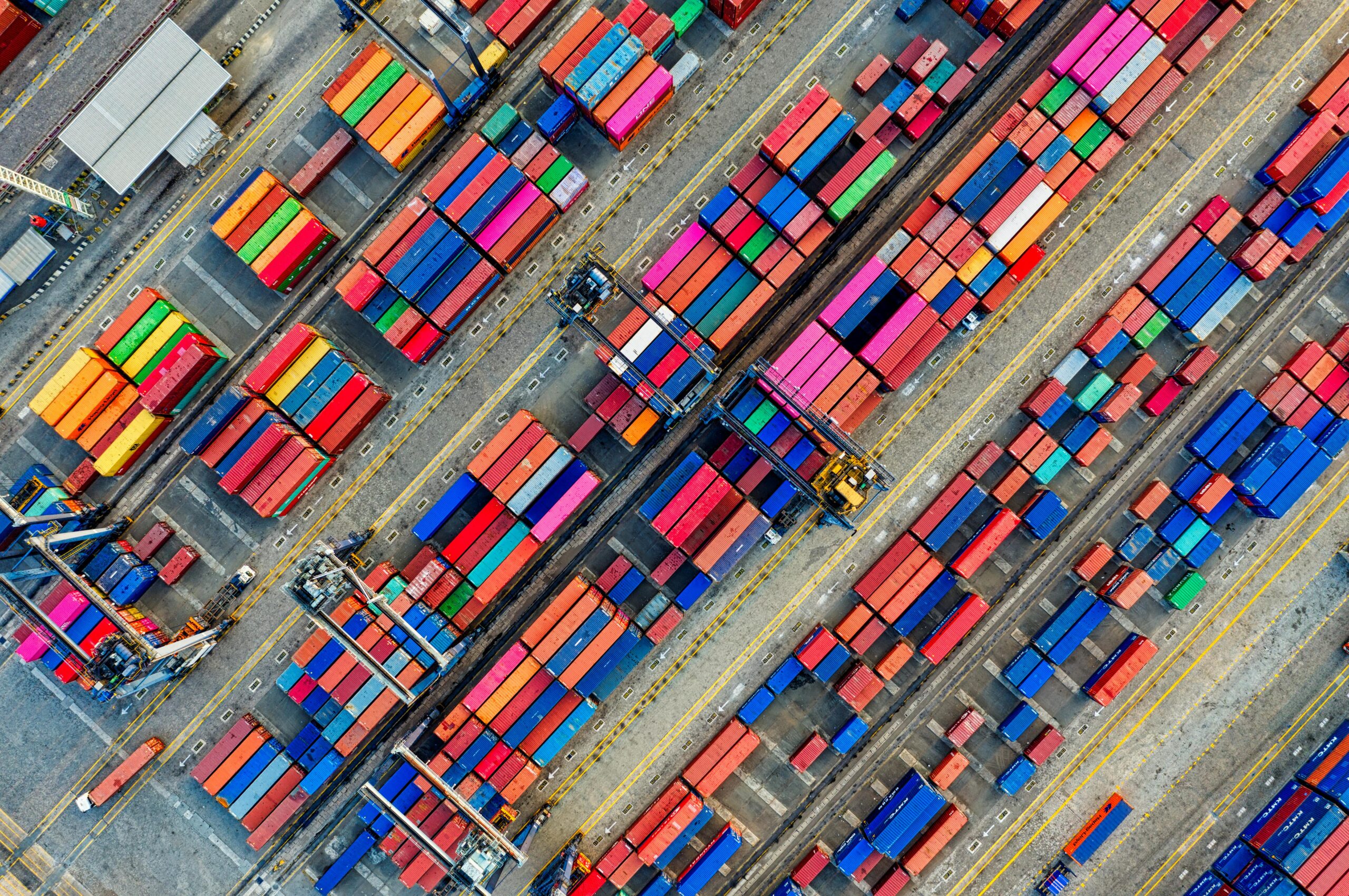

For US and European importers, destination port dwell time—the period from when a container arrives at the port to when it’s picked up and moved out of the terminal— is a critical yet often overlooked part of the supply chain. Extended dwell time doesn’t just delay cargo delivery; it triggers a cascade of costly consequences: detention and demurrage fees, storage charges, missed customer deadlines, and tied-up capital. In 2024, industry data shows that average dwell time at major US and European ports ranges from 2–5 days for smooth operations to 10–15 days during congestion—costing importers $100–$300 per container per day in additional fees. This guide breaks down the key causes of extended destination port dwell time for Western businesses, quantifies the hidden costs, and shares actionable strategies to minimize delays and protect your bottom line.

What Is “Normal” Dwell Time at US & European Ports?

Dwell time varies by port, season, and cargo type, but understanding baseline expectations helps you identify red flags. Below are 2024 industry benchmarks for major US and European destination ports (dwell time = terminal arrival to container pickup):

- US Ports:

- Los Angeles/Long Beach (US West Coast): 3–7 days (peak season: 7–12 days)

- New York/New Jersey (US East Coast): 2–5 days (peak season: 5–10 days)

- Savannah (US East Coast): 2–4 days (peak season: 4–8 days)

- European Ports:

- Rotterdam (Netherlands): 2–4 days (peak season: 4–9 days)

- Hamburg (Germany): 2–5 days (peak season: 5–11 days)

- Antwerp-Bruges (Belgium): 1–3 days (peak season: 3–7 days)

- Valencia (Spain): 2–4 days (peak season: 4–8 days)

Key Note: These times exclude customs clearance delays (which add 1–3 days on average) and last-mile delivery. Any dwell time exceeding the port’s “free time” (typically 3–5 days for US ports, 2–4 days for EU ports) triggers detention/demurrage fees.

Top Causes of Extended Destination Port Dwell Time (US & Europe Focus)

Extended dwell time is rarely caused by a single issue; it’s often a combination of terminal operations, regulatory hurdles, and importer-related delays. Below are the most common causes impacting US and European importers:

1. Port Congestion & Terminal Operational Bottlenecks

Port congestion is the #1 external cause of extended dwell time. Major US and European ports handle millions of TEUs annually, and bottlenecks—from understaffed terminals to limited yard space—create backlogs that slow cargo movement. For example: US West Coast ports (LAX/Long Beach) frequently face congestion during Q3–Q4 (holiday peak season), with container yards reaching 85–90% capacity—slowing pickup times by 3–5 days.European ports like Hamburg and Rotterdam struggle with labor shortages (e.g., dockworkers, crane operators) that delay unloading and loading, extending dwell time for inbound cargo.

2. Customs Clearance Delays (US CBP & EU Customs)

Customs hold-ups are the top importer-related cause of extended dwell time. Incomplete documentation, incorrect declarations, or non-compliance with US Customs and Border Protection (CBP) or EU Customs regulations can trap cargo at the port for days or weeks. Common triggers include: Missing or inaccurate paperwork: Errors in commercial invoices (undervalued goods, inconsistent product descriptions), incorrect HS code classification, or missing origin certificates (critical for preferential tariffs in US-EU trade).Non-compliance with product regulations: Lack of CE marking for goods sold in the EU, failure to meet US FDA requirements for food/pharmaceuticals, or shipments involving restricted items (e.g., electronics without FCC certification).Targeted or random inspections: CBP and EU Customs prioritize high-risk cargo (e.g., textiles, electronics, pharmaceuticals) for inspections, which add 2–5 days if cargo isn’t prepped with required documentation.

3. Importer/Receiver Readiness Issues

Many dwell time delays start with the importer or their designated receiver. Unpreparedness to pick up or process cargo leads to containers sitting idle in the terminal: Lack of pre-arranged trucking: US and European importers often wait until cargo arrives to book a truck, leading to delays if trucking capacity is tight (common during peak seasons).Warehouse capacity shortages: If the importer’s warehouse is full, they can’t accept the cargo—forcing containers to stay in the port and accrue storage fees.Late payment of fees: Unpaid terminal handling charges (THC) or customs duties prevent cargo release, extending dwell time until payments are processed.

4. Carrier & Documentation Coordination Failures

Miscommunication or delays in sharing critical documents between carriers, freight forwarders, and importers can stall cargo release: Late submission of delivery orders: Carriers often require a delivery order (DO) to release cargo, and delays in processing the DO (due to missing bill of lading information or payment issues) extend dwell time.Inconsistent data across documents: Mismatched container numbers, consignee details, or cargo descriptions between the bill of lading, commercial invoice, and customs declaration trigger manual reviews and delays.

5. Seasonal & External Disruptions

Seasonal factors and unforeseen events amplify dwell time: Peak seasons: Q3–Q4 (holiday goods) and January–February (post-holiday restocks) increase cargo volume, straining port resources and extending dwell time.Weather events: Winter storms (US Northeast, Northern Europe) or hurricanes (US East Coast) disrupt port operations and trucking, delaying cargo pickup.Labor disputes: Dockworker strikes (e.g., 2023 US West Coast port labor negotiations, 2024 French port strikes) halt terminal operations entirely, leading to indefinite dwell time extensions.

The Hidden Costs of Extended Dwell Time for US & European Importers

Extended dwell time isn’t just a delay—it’s a financial drain. Below are the most impactful costs, based on 2024 industry averages:

- Demurrage & Detention Fees: Charged by carriers when cargo exceeds free time. US ports: $100–$200 per container per day (rises to $250–$300 after 7 days). EU ports: €80–€150 per container per day.

- Terminal Storage Fees: Charged by ports for containers stored beyond free time. $50–$100 per container per day in US ports; €40–€80 per container per day in EU ports.

- Missed Deadlines & Penalties: Delayed customer deliveries can trigger contract penalties (5–10% of order value) or lost sales (especially critical for seasonal goods like holiday inventory).

- Tied-Up Capital: Cargo sitting in the port means capital is locked in inventory, reducing cash flow for other business needs.

- Emergency Shipping Costs: To mitigate delays, importers often resort to expensive expedited shipping (air freight) for replacement goods, costing 2–3x more than ocean freight.

Actionable Strategies to Reduce Destination Port Dwell Time

For US and European importers, reducing dwell time requires proactive planning, strong partnerships, and attention to detail. Below are proven strategies:

1. Prep Documentation & Clear Customs in Advance

Customs delays are avoidable with advance preparation: Work with a local US/EU customs broker to review all documentation (commercial invoice, packing list, HS codes, origin certificates) before cargo arrives. Ensure HS codes are accurate and compliant with CBP/EU regulations.Use pre-clearance services: Most US and EU ports offer pre-clearance, allowing you to submit customs declarations 3–5 days before cargo arrives. This cuts clearance time by 1–2 days and reduces dwell time.Obtain AEO status: Authorized Economic Operator (AEO) certification grants priority processing with CBP and EU Customs, reducing inspection risk and speeding up cargo release.

2. Plan Pickup & Last-Mile Logistics Proactively

Don’t wait for cargo to arrive to arrange pickup: Book trucking 7–10 days in advance (14 days during peak season) with a reliable local carrier. Prioritize trucking companies with experience at your destination port (e.g., LAX, Rotterdam) to avoid terminal access delays.Ensure warehouse capacity: Coordinate with your warehouse to free up space before cargo arrives. Use just-in-time (JIT) inventory management to avoid storage bottlenecks.Pre-pay fees: Pay terminal handling charges (THC), customs duties, and other fees in advance to avoid release delays due to unpaid invoices.

3. Choose the Right Port & Terminal

Not all ports/terminals are equal in terms of efficiency: Opt for less congested ports: For US West Coast shipments, consider Oakland or Seattle instead of LAX/Long Beach during peak season. For European shipments, Zeebrugge (Belgium) or Wilhelmshaven (Germany) are alternatives to Rotterdam/Hamburg.Select terminals with fast pickup options: Look for terminals offering “drop-and-pick” services or extended hours (24/7) to reduce wait times for truckers.

4. Partner with a Local Logistics Provider

A logistics provider with on-the-ground expertise at your destination port is invaluable:They monitor cargo in real time, alerting you to potential delays (e.g., customs holds, terminal congestion) and resolving issues proactively.They have established relationships with terminals, carriers, and customs authorities, enabling faster problem-solving (e.g., expediting inspection paperwork).They can arrange alternative pickup plans (e.g., rerouting to a nearby terminal) if your primary port is congested.

5. Leverage Technology for Visibility

Real-time visibility reduces uncertainty and allows for quick action:Use a logistics tracking platform that integrates data from carriers, ports, and customs. This lets you monitor cargo status (arrival time, clearance progress, pickup ETA) 24/7.Set up alerts for key milestones (e.g., “cargo arrived at port,” “customs cleared”) to trigger pickup coordination.

6. Negotiate Favorable Terms with Carriers

Negotiate extended free time (6–7 days instead of 3–5) in your carrier contract, especially during peak season. This provides a buffer for minor delays without triggering fees. Also, include clauses that hold carriers accountable for delays caused by their operational failures.

Take Control of Your Destination Port Dwell Time Today

Extended destination port dwell time is a costly, avoidable supply chain risk. With proactive planning, accurate documentation, and the right logistics partner, you can minimize delays, reduce fees, and keep your cargo moving smoothly—even during peak seasons.

Our team of global logistics experts specializes in supporting US and European importers with destination port optimization. We offer: Pre-clearance support and documentation review to avoid customs delays.Real-time cargo tracking and proactive alerts for potential dwell time issues.Access to reliable local trucking and warehouse partners at major US/European ports.AEO certification guidance and customs compliance support.Negotiation support for carrier contracts to secure favorable free time and fee terms.

Contact us today for a free dwell time assessment. Let’s analyze your current supply chain, identify risk areas, and create a tailored plan to reduce delays and save you money. Don’t let destination port dwell time eat into your profits—take action now.

Category: Logistics transportation timeliness

Related Posts

Top 10 Factors Affecting Sea Freight Transit Times & How to Manage Them

Top 10 Factors Affecting Sea Freight Transit Times & How…

Why Transit Time Matters More Than You Think: A Data-Driven Approach

Why Transit Time Matters More Than You Think: A Data-Driven…

Comparison of Speeds of Fast Ships vs Slow Ships

Comparison of Speeds of Fast Ships vs Slow Ships For…